The myth of poor rural Romania is fading:

Bucharest, 12 October 2022.

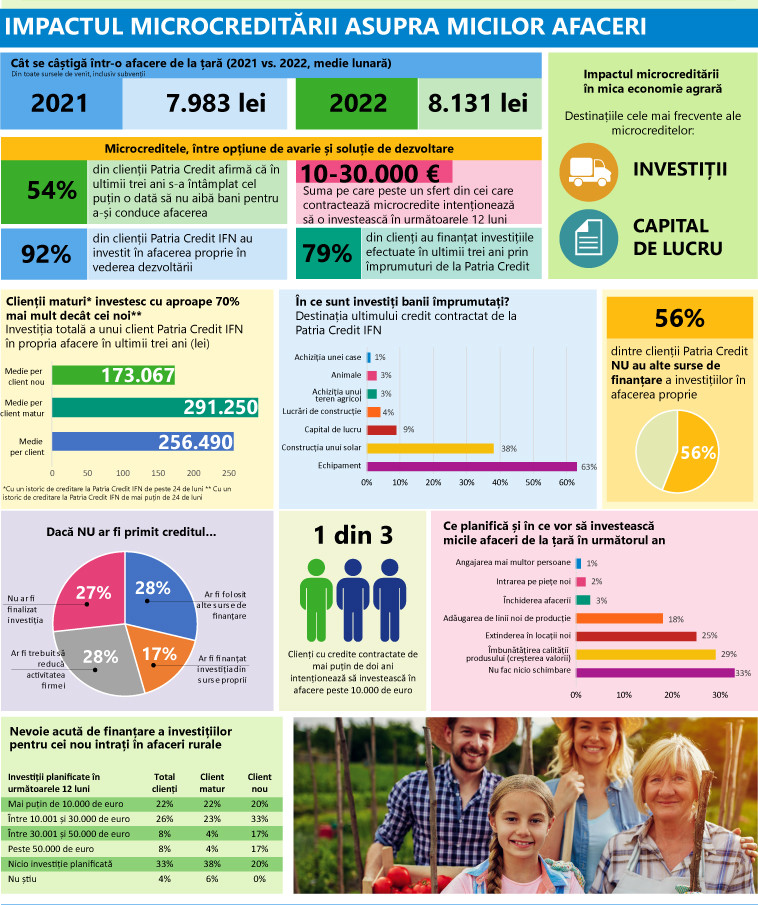

For individual households and small businesses (predominantly but not exclusively agricultural) in rural areas and small towns, microcredit is often the only option for the future: for securing a decent income, for developing a small family business or sometimes for keeping it afloat. For the first time in Romania, the Patria Credit Foundation has analysed the social and economic impact of microcredit from three points of view: its effects on households, small businesses and rural and small urban communities. The study focused on data analysis and interviews with clients of Patria Credit IFN, local authorities and actors in three communities where the financing institution has been present for more than 10 years: two rural communities (Matca, in Galati county, and Scărișoara, in Olt county) and one small town, namely Târgu Frumos, in Târgu Frumos county. Iași. What do the Romanians from villages do with microcredits: investments, not current expenses! Thus, în relation to the first axis, i.e. the impact of microcredit on small businesses in rural and small urban areas, it demonstrates the essential importance of access to finance for categories of clients who, for various reasons beyond their control, have no or limited access to conventional banking and related services. According to the research results, 92% of Patria Credit IFN customers invested the money they borrowed to grow their small business. Only 9% used those amounts for working capital. &If they did not have access to the money they received through the loan, more than half of the respondents (55%) said that they would either have had to reduce the activity of the company (28%) or would not have completed the investment (27%). The proportion of respondents who depend on external sources to finance their investments is very close to that of those who said that they had at least once in the last three years not had enough money to run their business (54%). The main economic activity of Patria Credit IFN clients in the communities surveyed is agriculture, îespecially vegetable growing (74% of respondents), followed by grain growing (14%) and animal husbandry (8%). However, there are significant differences in the structure of the activities according to the residence of the business: while agriculture predominates in rural areas, non-agricultural activities (livestock farming), trade or services are also practiced in towns such as Târgu Frumos. According to the study, 79% of Patria Credit clients have financed their investments în their own businesses în the last three years with îm loans from this institution. Most often, microcredit borrowers use the amounts to purchase equipment (63%), build a solar farm (38%), for working capital (9%), construction work (4%), purchase agricultural land (3%), purchase livestock (3%) or a house (1%). Only 9% of Patria Credit clients have used the loan amounts for purposes other than financing their own business. Access to funding puts local development on fast forward Connecting the local business environment to sources of finance correlates with an accelerated rate of development. In Matca commune in Galati county, one of the three localities included in the research, the number of households almost doubled in 2021 compared to 2010, rising from 4,200 to around 7,300. The number of local firms also increased from about 150 to 1,070. The highest increase is in the number of firms active in agriculture, which in 2021 was more than 700, 50 times more than in 2010. The number of farmers under 35 also increased fivefold, from 500 in 2010 to 2,500 in 2021.

In the same time frame, the average loan amount Patria Credit extended to customers in Matca tripled, the amount of the smallest loan extended increased sixfold, and the median loan amount increased nearly fourfold. „Data from the Patria Credit Foundation study confirms the positive impact that îl access to finance has on the local economy, împroving significantly the social situation of these communities”, says Raluca Andreica, CEO Patria Credit and Executive Director of Patria Credit Foundation.

The findings of the study blatantly contradict a number of common myths: that the rural economy is in decline, that people use microcredit to survive from one month to the next, that farming is not profitable or that young people are not attracted by the prospect of working on the farm. On the contrary, where the conditions are right, we see thriving communities that are also struggling but can bounce back if they receive support.

Probably the most important outcome of the research is that we have been able to demonstrate the social impact of microcredit. For example, school dropout has been reduced where people have access to development resources – for example – in localities such as Scarișoara commune, where the children of over 90% of Patria Credit clients manage to graduate from secondary school – and go on to study at high school – in neighbouring Caracal. ÎIn Matca commune, school dropouts have completely disappeared; all children go to school.”

Access to microcredit correlates with increased spending on education

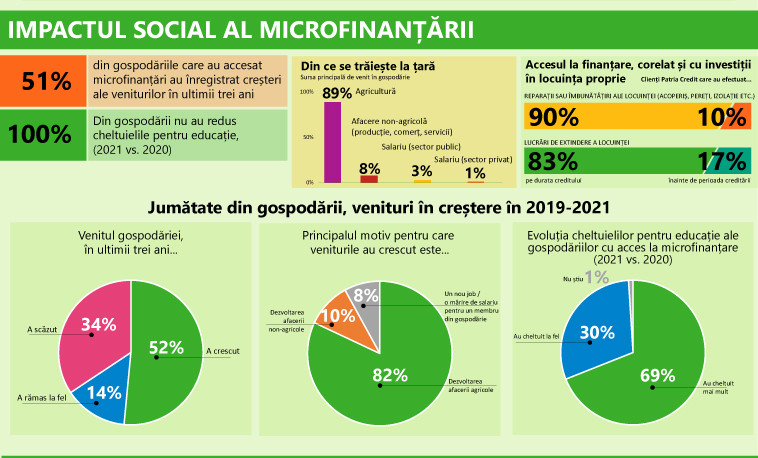

In addition to boosting local small businesses, the Patria Credit Foundation study shows that îin the targeted communities (rural and small urban) access to finance also has a social impact – this is the second thrust of the research. Thus, more than half (51%) of the households that accessed microfinance have înregistered increases in income în the last three years (2019-2021), the main reason indicated being the development of the agricultural business (82% of respondents). None of the sampled households îin the sample reduced their spending on education îin 2021 compared to 2020; on the contrary, more than two-thirds of respondents (69%) said that îin 2021 they spent more on children's education than îin the previous year.

Community impact: 80% of firms are (also) run by women

The third strand of the research, community impact, focused on analysing the ability of agricultural producers to form associations (to gain access to the sales networks of large retailers or to storage and processing capacity at EU level) and on employment. The main findings were that only 13% of Patria Credit IFN's clients have benefited from the services of an economic association in the region, the low degree of association being a structural problem of Romania's rural economy. The study also showed that 80% of the businesses lent by Patria Credit IFN are run by women.

Toolkit for assessing the social impact of funding institutions

To assess social impact, the study describes and proposes an analysis methodology, a „toolkit” consisting îof a set of 22 indicators grouped into three dimensions:

- provision of financial services to people/small businesses from vulnerable backgrounds (categories), an indicator reflecting the degree of financial inclusion îin the targeted public category

- quality of life of clients, i.e. whether people with a lower standard of living and who would have difficulties obtaining credit from banking institutions have access to credit

- the impact of financing, i.e. whether microcredit helps to increase not only individual but also community well-being by stimulating employment, especially for women

The final score is distributed on a scale from 0 to 60 points, reflecting high (40 - 60 points), medium (20 - 39 points), or low (below 20 points) social performance.

The Tollkit can be downloaded from here

About the research

The study was conducted by a team of researchers - Claudia Petrescu, researcher at the Institute for Quality of Life Research, and Roxana Săvescu, lecturer at „Lucian Blaga” University of Sibiu, under the coordination of Patria Credit Foundation. The study was carried out with the financial support of Patria Credit IFN SA and the European Fund for South-East Europe (EFSE). The sample consisted of 120 households in the municipalities of Matca (Galați county) and Scărișoara (Olt county) and the town of Târgu-Frumos (Iași county), clients of Patria Credit IFN SA. Primary data were collected through a survey (questionnaire) administered to the entire sample, as well as through interviews with local stakeholders (mayors and representatives of local authorities), area managers of Patria Credit IFN SA, and through 12 case studies on clients. The primary data was complemented by desk research & public databases, Patria Credit IFN internal data and various other sources: reports from other microcredit institutions (FINCA), European case studies, studies and research reports on social impact assessment of microcredit published internationally.

***

About Patria Credit IFN

Patria Credit IFN SA is a non-bank financial institution (NFI) that supports the efforts of rural and small urban entrepreneurs and their positive impact on their communities. Specializing în farmer financing, Patria Credit is a member of European Microfinance Network (EMN) and Microfinance Centre (MFC) and is the first non-bank financial institution dedicated to microfinance in Romania, with almost 20 years of experience and more than 17,000 clients financed. Patria Credit's history began in 1996, initially as a program of the World Vision organization, later evolving into a foundation and then an NFI. Part of the Patria Bank Group, Patria Credit IFN is involved in projects supporting agriculture, rural development and the revival of agricultural education, such as Business Breeding, Mândru să fiu fermier (together with World Vision Foundation Romania), Foundation for Agricultural Development (FD Agri), etc. In 2021, Patria Credit and Patria Bank reactivated the Patria Credit Foundation, through which they aim to reduce social, economic and financial exclusion of rural communities, promote the popularization of sustainable agricultural practices, facilitate the growth of the new generation of young farmers and raise awareness of the importance of rural community development.