Patria Credit announces 2021 financial results and plans for 2022: 42% higher net profit, new digitization and agritech projects

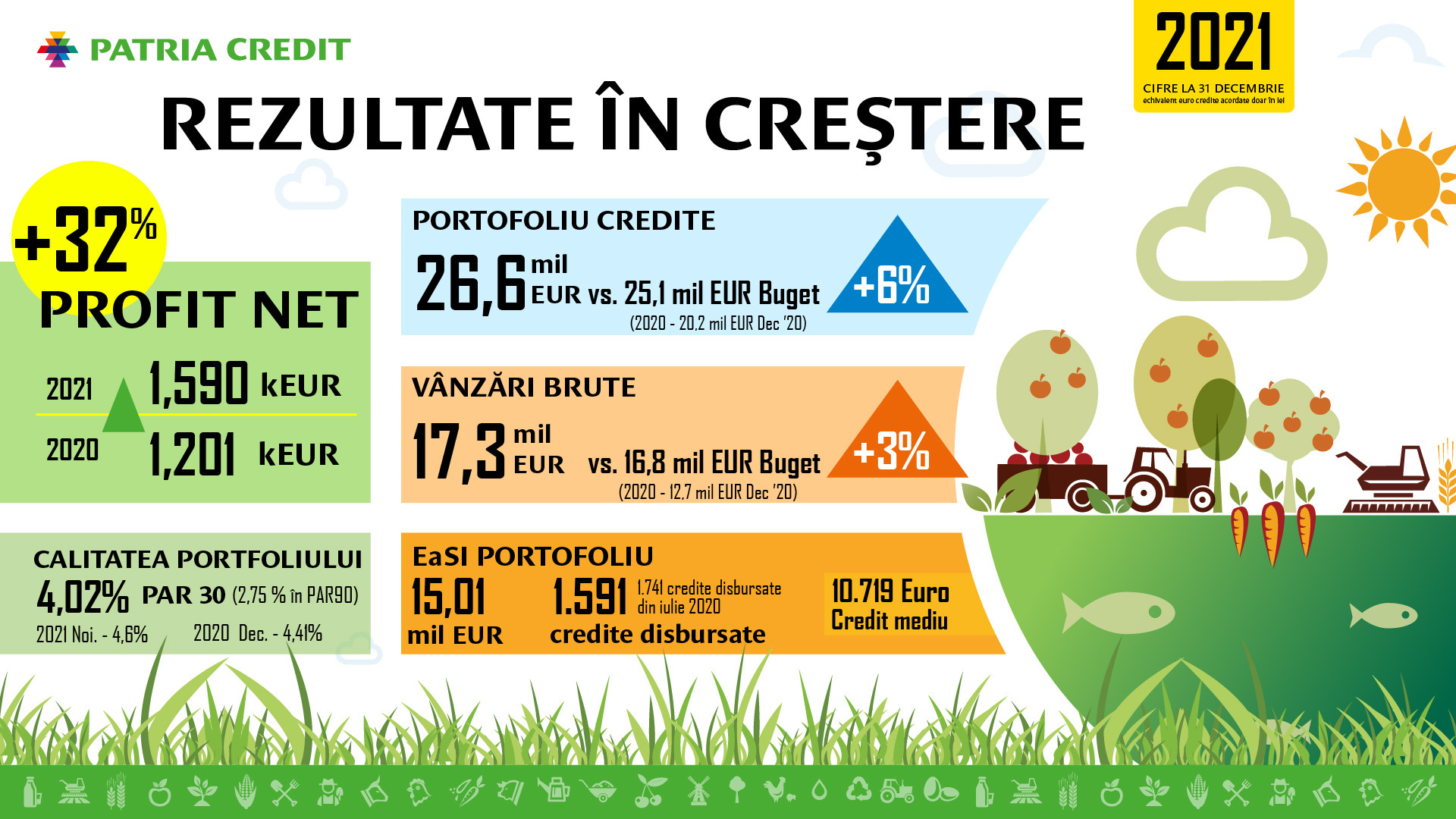

- Patria Credit, a non-bank financial institution specialising îin providing microcredit for farmers, recorded în 2021 net profit of €1.59 million, 42% higher than in 2020, marking its 6th year of sustained growth and a rebound in demand after the first year of pandemics

- The loan portfolio reached €26.6m, up €6.5m (32%) on the end of 2020

- The number of Patria Credit customers also climbed by 8.5% compared to 2020

- For 2022, the institution announces the launch of an agritech (digital crop monitoring) pilot project and digitization of operations

- On completion of the digitisation process, the waiting time for obtaining a credit would be a maximum of 48 hours

Bucuresti, 17 March 2022. Patria Credit IFN SA, a non-banking financial institution part of Patria Bank Group, has în recorded în 2021 net profit în up 42% compared to the previous year's result – respectively 1.59 million euros compared to 1.12 million euros în 2020 (preliminary results, în being audited).

Patria Credit also broadened its customer base, with the number of customers up 8.5% from the previous year's level, while the return on capital exceeded 35%.

&In the sector of non-bank financial institutions in Romania, Patria Credit stands out for its product offer, microcredits addressed mainly to micro-firms which, for various reasons, most often: distance (remote rural locations), lack of collateral (mortgages) and lack of traditional financial documents, cannot access loans offered by banks.

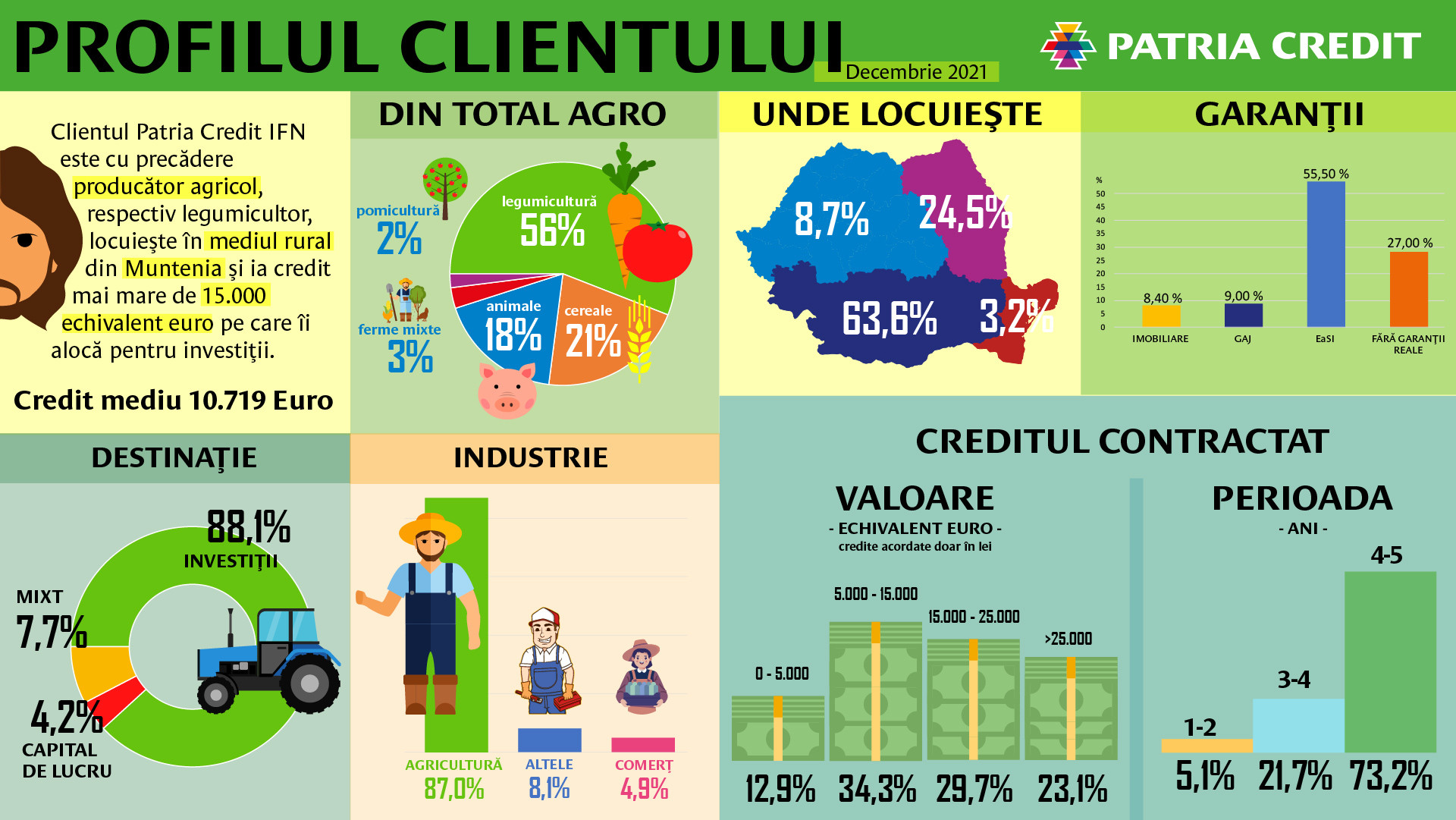

The majority of the company's clients are agricultural producers in the Muntenia area, who account for 63.6% of all financed businesses. Producers in the region of Moldova rank second in terms of share of total clients, representing 24.5%.

The majority of clients are specialised in vegetable production (56%, compared to only 21% cereal production and 18% livestock), who access loans of up to EUR 15,000 with a maturity of 4-5 years, which are intended for investment in production.

Most of the loans granted, over 34% of the total, have a value between €5,000 and €15,000, followed by loans with values between €15,000 and €25,000, which represent 29.7%.

The average value of loans granted in 2021 was €10,719. The vast majority of loans (over 88%) are for investment purposes, with just over 4% taken out to cover working capital, while 7.7% are for mixed purposes.

Loans without collateral – în top

„The excellent financial results we în recorded last year are îmainly due îto proper portfolio management and broadening the customer base”, says Raluca Andreica, CEO of Patria Credit. „Thus, we exceeded the targets set for almost all main indicators: at the end of last year the total loan portfolio amounted to €26.6m, €1.5m above the target and more than €6.5m more than the level ”

The largest part of the loan portfolio is EaSI, a loan without collateral (for 90% of the amount îmborrowed) îin a maximum amount of 120,000 lei. It is financed by the European Union from the European Investment Fund, the EU's specialised instrument for private equity, guarantees and microfinance instruments designed to support SMEs, micro-enterprises and social enterprises. Moreover, the microcredit institution has îon-going agreements whereby risks are taken over by institutional partners or funders such as the EIF or the European Fund for South East Europe (EFSE). &If 2021, Patria Credit has increased the guarantee ceiling for EaSI loans by €36 million, amid very high demand, demand that continues în the first months of the year, when the new guarantee instrument is expected to be launched.

The institution's lending procedure does not involve the classic documentation required by banks, but is based on a personalised analysis of the farmer's budget, crop type and production cycle.

The quality of the portfolio also contributed to Patria Credit's 2021 result. Outstanding loans with întâarrears of more than 30 days represent just over 4% of Patria Credit's total portfolio, îwhile the rate of non-performing loans, with întâarrears of more than 90 days, stands at 2.75%.

„&If it comes to costs, îin 2021 we were able to reduce the cost of funding by almost one percentage point compared to the previous year, after îin 2020 we reduced the cost of funding by more than 0.5 pp”, explains Andreica. „It is a result that confirms that we are a solid financing institution, with the capacity to support the development of SMEs in Romania's agriculture, a sector whose attractiveness is growing.

În 2022, digitization and agritech projects

For this year în, Patria Credit has îin progress a number of major investment projects. One of them, already înced, is the change of the internal IT architecture, which continues the process of digitization of operations to better serve the sales force and to optimize the integration with partners through various APIs. Thus, the goal is to offer customers fully digital services, while the credit granting time would reach a maximum of 48 hours. Patria Credit will also open two new agencies în two areas with high agricultural potential in the country, after opening Tulcea and Botoșani last year.

The institution is also to launch a pilot digitization project in Izbiceni for the benefit of vegetable producers, consisting of the installation of probes to collect agro-meteorological parameters in vegetable crops, in order to simplify the management of production cycles, the control of environmental factors and stress or risk factors for crops. Eight small farmers will receive support for the installation of the probe system, with the costs covered by Patria Credit and its partner, the mobile weather station manufacturer Enten.

„We are încânted to launch this project. The data collected automatically through digital crop monitoring, a primary component of the agritech ecosystem, is invaluable to agricultural producers. On the basis of this data, for example, it is possible to establish the timing of agricultural work and treatments, generate weather forecasts and track the phenological evolution of crops, create predefined models for disease, pest and work management, etc. We are also planning to launch environmentally responsible green credit products," says Raluca Andreica.

*** About Patria Credit IFN Patria Credit IFN SA is a non-bank financial institution (NFI) that supports especially the efforts of entrepreneurs and private individuals and their positive impact on rural communities. Specializing în farmer financing, Patria Credit is a member of European Microfinance Network (EMN) and Microfinance Centre (MFC) and is the first non-bank financial institution dedicated to microfinance in Romania, with almost 20 years of experience and more than 15,000 financed clients. Patria Credit's history began in 1996, initially as a program of the World Vision organization, later evolving into a foundation and then an NFI. Part of Patria Bank Group, Patria Credit IFN is involved in projects supporting agriculture, rural development and the revival of agricultural education, such as the Business Breeding, Mândru să fiu fermier (together with World Vision Foundation Romania), Foundation for the Development of Agriculture (FD Agri) etc.